Projecting attendance isn’t just “educated guessing” anymore. Here’s what cultural executives and board members need to know about this data-informed – and increasingly critical – process.

“Market potential” may sound like jargon for “expected attendance,” but not all predictive research processes are created equal. When it comes to understanding expectations surrounding attendance, most entities cannot afford to get things wrong – especially now.

Simply put, having a realistic sense of how many people intend to walk through an organization’s doors allows for accurate budgeting, planning, and program prioritization. We don’t still live in a world where “educated guesses” are the norm. Intelligent market potential analyses are informed by data science and advanced modeling processes. (Stick with us. We’ll explain!)

Market potential analysis – or, helping cultural entities to understand reliable attendance projections for planning purposes – is a big part of what we do at IMPACTS Experience. If you’re a regular reader, then you already know that we periodically share composite market potential analysis for exhibit-based organizations and performance-based organizations in the United States. We can even break down anticipated attendance by quarter in a way that contemplates vaccinations, organizational programming, and current perceptions of cultural organizations.

Today, we’d like to explain more about the market potential analysis modeling process and show you how to properly approach the composite analyses shared on this site if your organization does not have its own individual market potential analysis or advanced attendance projection.

If you’ve worked with us, then you know that the IMPACTS Experience team is composed of, well, a bunch of cultural data nerds who can get overly math-y in short order. On this site, we strive to provide high-confidence research alongside accessible analysis. Sure, deploying multi-agent simulation processes sounds fancy, but you need to know what the outcomes of these simulations actually mean for the executive management of your organization and its operations.

We’re going to thank you at the outset of this article for understanding that there’s just no way around some of the technical language here. This said, we’ve worked hard to make this as straightforward as possible for this site’s broad audience that ranges from board chairs who work with major companies to college whippersnappers here because it’s required reading for their major. (Hey, student learners! We’re glad you’re here and interested in the cultural industry!)

What is market potential analysis, in a nutshell?

Market potential for cultural enterprise is a modeled measure of the size of the market for these experiences at a specific time. It is the product of modeling robust data relating to the US public’s attitudes, perceptions, and behaviors that leverage models of both the market and the experiences offered to the public by cultural organizations. The outputs of the simulated interactions between these two models during a defined duration are quantified to produce a data-informed attendance forecast.

Most frequently, we consider market potential in terms of onsite attendance numbers (i.e., volume of visitation). While IMPACTS Experience specializes in deploying these technologies on behalf of specific organizations, the composite market potential research on this site provides a benchmark for the overall market potential for both US exhibit and performance-based entities to provide a sense of realistic expectations. To that end, the research published on this site – which we see used in board rooms throughout the country – is a composite intended to provide a broad direction for the cultural sector as a whole, rather than representing specific numbers for any individual organization. For example, a zoo in Texas likely has a different market potential than a children’s museum in Los Angeles, even though they are both included in the “exhibit-based” category in this research.

While we generally cut the data on this site into two categories (exhibit and performance-based organizations), we are also able to provide market potential analyses for specific organization types (i.e. attendance projections for art museums), or for specific regions (i.e. attendance projections for museums in New England). Given the breadth and depth of our ongoing research, we often apply the data to both criteria (i.e. attendance projections for art museums in New England), and we do this frequently for partners and select workshops. All this said, the best way to understand your own organization’s attendance projections is to conduct an individualized analysis. We can help you with that, too.

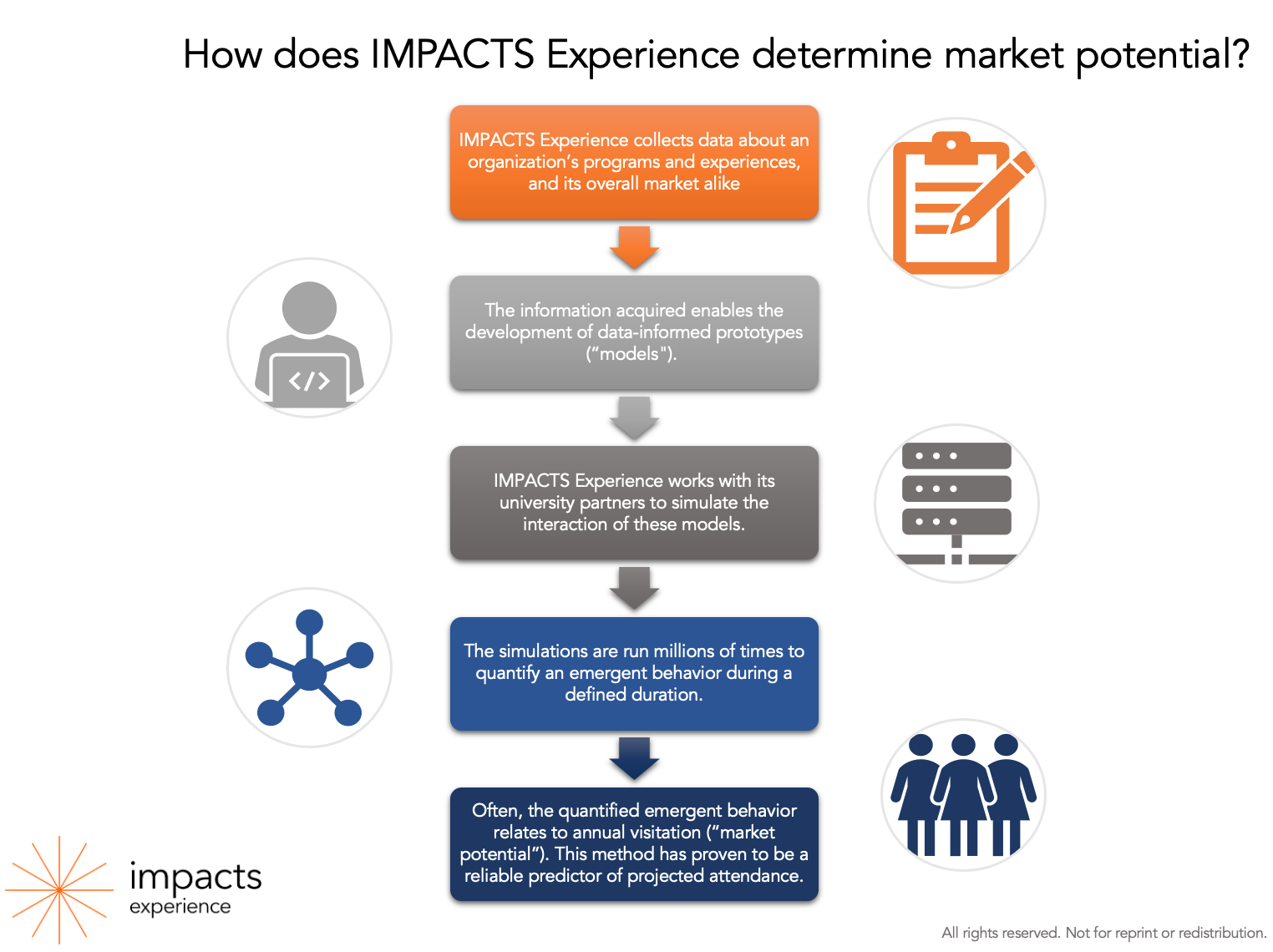

How does IMPACTS Experience determine market potential?

Great question, and the short answer is that we carry out these analyses thanks to our fearless leader: Math! …along with its trusty sidekicks: modeling, behavioral economics, data science, and our great university partners.

A brief overview of our market potential analysis process is as follows, as de-jargoned as possible:

1) IMPACTS Experience is constantly in-market collecting research about organizations’ programs alongside the perceptions and behaviors of potential visitors.

We are tracking perceptions and behaviors surrounding 224 visitor-serving organizations in the US on an ongoing basis. These organizations range from zoos, aquariums, and museums, to theaters and symphonies, to festivals. We also manage what is believed to be the largest in-market survey of perceptions and behaviors in the US with upwards of 355,000 cumulative respondents (as of Q2 2024). This study is called the National Awareness, Attitudes, and Usage study (NAAU) and it was originally founded in partnership with several foundation, university, and organizational partners in 2010.

Since its founding, the NAAU has supported research processes beneficial to organizations far beyond the cultural sector. The data we collect with the NAAU has aided work with partners and projects concerning the European Union, Google, Facebook, Monterey Bay Aquarium, The Re-Election Campaign of President Barack Obama, Stanford University, United Nations Educational, Scientific and Cultural Organization (UNESCO), U.S. Department of State, and Warner Brothers Entertainment, to name a few.

In sum, IMPACTS Experience is collecting a lot of research that enables a lot of advanced data-driven analyses for various organization types. It is because we are constantly in-market collecting representative research that we are able to organize research based on regions or organization types without necessarily needing to conduct separate, independent studies in many cases. Want to know what people in San Francisco think about zoos, for instance? We might not need to start from scratch on a survey – we’ve likely already been collecting related information and can share these data outcomes quickly.

2) This research enables the development of data-informed prototypes (models).

One of the specific benefits of collecting all of this information is that it enables sophisticated predictive technologies such as market potential analysis.

For a market potential analysis, the data collected enables us to prototype both an organization and perceptions and behaviors surrounding that institution, as well as a prototype of current conditions in the marketplace. In other words, we create a data-informed model of both the market and a product or experience.

For individual organizations, we collect specific additional research to comprehensively fill in any knowledge gaps and ensure we have a strong hold on perceptions and behaviors surrounding that organization. This comprehensive, nuanced understanding of an individual organization is vital to developing accurate attendance projections specifically for that institution. Another benefit of conducting a market potential analysis is that this market research itself (e.g. satisfaction metrics, admiration quotients, why people do or do not intend to visit in a defined duration, etc.) is often useful to organizations.

In the case of the composite market potential analyses frequently shared on this site, these models are developed based upon the overall perceptions of experiences surrounding the exhibit or performance-based organizations we’re tracking (or all art museums, or all science centers, or all performance entities in Dallas, etc., depending on the market potential analysis we’re interested in uncovering).

3) IMPACTS Experience works with its partners to simulate the interaction of these models.

Once we have prototypes based on both the market conditions as well as the perceptions and behaviors surrounding a specific institution, it’s time for even more advanced data science. We work with our partners – most typically university partners with access to supercomputational capacities – to model these data. In our lexicon, we refer to these modeling processes as “running simulation trials,” which is our way of saying we’re attempting to virtually simulate the expected behaviors of our audiences.

4) The simulations are run millions of times to quantify an emergent behavior within a defined duration.

We run these simulation trials millions and millions of times (thank you, supercomputers!) to develop a data-informed estimate of future attendance potential. By running these simulations over and over so many times and quantifying the expected interactions between our target audiences and the experiences that organizations offer, we are able to identify an emergent behavior – in this case, the likelihood of people actually engaging with an experience within a defined duration.

In addition to uncovering the most likely scenarios, these models also contemplate the potential for various Black Swan-type risks such as major climate events (hurricanes, etc.), labor disruptions (employee strikes), civil unrest, crime (active shooters, etc.), other mass casualty events (plane crash), natural occurrences (seismic activity), terrorism…the list goes on. In essence, the models contemplate not only the likelihood of more usual factors but also the things that can make a bad day a bad year.

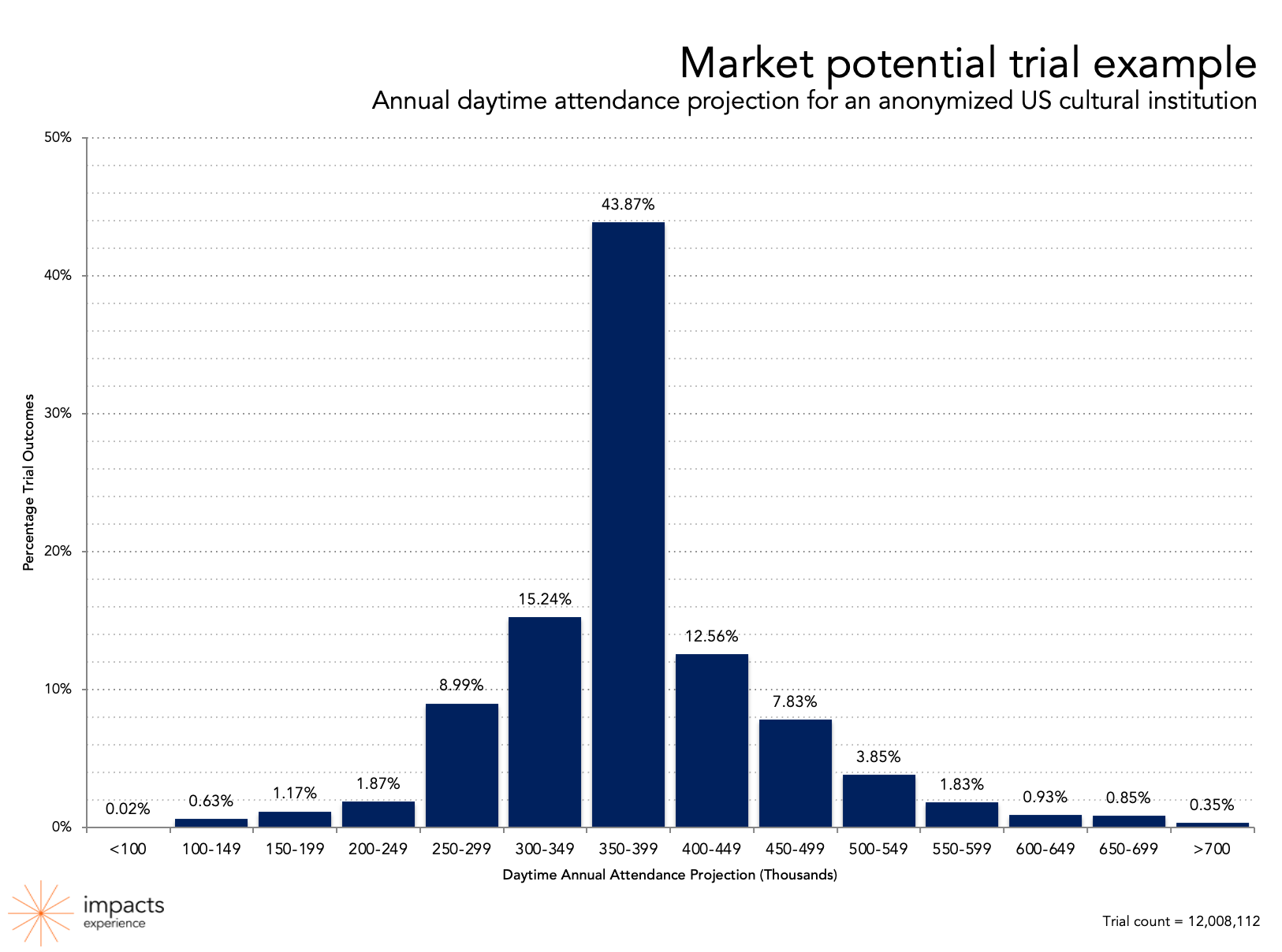

Take a look at the example below that we reviewed in this article on Black Swan-type events. This is an example of a market potential analysis for an anonymized visitor-serving organization. The analysis dates back to 2016 and is the product of more than 12 million trials simulations. The outcome of this type of trial informs the organization’s expected annual daytime attendance.

If the above modeled year did not suffer any major disruptors, then this organization could reasonably expect between 350,000–399,000 attendees. And with 368,294 attendees that year, that’s exactly what happened. (This outcome is consistent with similarly realized, actual results compared to market potential estimates borne of this type of data-informed modeling process. Of the more than 12 million trials, the single most common outcome – rounded to the nearest 1,000 daytime visitors – was 366,000. In this example, the variance between the most common outcome and actual attendance was 0.6%.)

These simulations also yield the attendance projections that we share on this site, as well as for specific organizations, sectors, or entity types.

5) The method has proven a reliable predictor of attendance.

Why do we use this methodology? Because it’s proven to be reliably accurate. On average, IMPACTS Experience projections are within 2.5% of observed outcomes.

As we’ve discussed before, Black Swan events do happen, and these models also provide a realistic view as to the likelihood of a major disruptive event. Just seeing a specialized market potential analysis for an organization has proven incredibly helpful in aiding leaders to understand their most likely realities – including potential risks. Understanding risk factors can help leaders remember that we can come close to predicting the likely outcomes using data science, but there’s still reason to prepare for various unexpected conditions. As we are still trying to overcome this darn pandemic, this lesson may be particularly relevant to our current conditions.

Two things to remember about market potential:

Let’s go through some important points about market potential and specifically the nonproprietary research we are able to share with our tens of thousands of monthly readers on this site.

Analysis for your institution is most helpful, but composite market potential analysis provides a benchmark to ground-truth annual expectations for the sector.

There are benefits to both kinds of analysis. Obviously, uncovering the market potential for your own organization provides the likelihood of attendance figures for your specific institution.

But understanding composite market potential – the overall expected percent of 2019 attendance predicted for exhibit or performance-based institutions on the whole – provides a critical benchmark for organizations. Why is this broad composite analysis helpful to your specific organization? Well, if your internal planning processes suggest that you expect your organization’s attendance to vary dramatically from the industry composite, perhaps you should consider this variance with caution. Why are your numbers so departed from the industry’s expectations? Are you being realistic in your planning processes? Are you being too conservative and, thus, risk maximizing your engagement potential? Or are you being too optimistic and, thus, risk busting your budget? Or perhaps there is a perfectly valid reason why your specific circumstances warrant a projection that differs significantly from the industry expectation. The point is, industry benchmarks should encourage inquiry and contemplation when it comes to planning processes.

We’re still in an unstable condition in the US due to the pandemic.

Prior to 2020, we were able to conduct one market potential analysis per year, as we observed market potential for the sector as a whole to be generally stable. But remember that we’re in a unique time given the pandemic, evolving health protocols, vaccinations, unvaccinated children, and the rise of the Delta variant. In sum, in our sixteen years of conducting these types of processes, it is a rare occurrence during which multiple factors spanning vast geographies dramatically influence attendance to an entire sector at the same time. Still, here we are in 2021, with a unique multiplicity of unforeseen, rare factors influencing behaviors on multiple fronts for an entire nation.

This condition means market potential has been changing significantly more than usual, but still less dramatically than leaders may believe. As a result, we’ve pulled market potential twice this year rather than just once. And we’re watching numbers closely.

Presumably, things will even out at some point when we get a handle on the coronavirus and its variants. For now, though, remember that we’re still experiencing a historically unique situation for modern times and the sector is still aiming to find stable foot as conditions continue to change more than usual.

We’re watching the effect that the rise in the Delta variant is having on perceptions and behaviors surrounding cultural organizations. And of course, we’re still monitoring the perceived desire for masks in the US.

We’ll see you here with new data on the current conditions in our next article on August 18th. Until then, be safe and keep swimming, cultural executives. We’re hopeful we’ll have helpful information to share to help you weather these storms.

IMPACTS Experience provides data for the world’s leading organizations through workshops, keynote presentations, webinars, and data services such as pricing recommendations, market potential analyses, concept testing, and Awareness, Attitude, and Usage studies. Learn more.

We publish new national data and analysis every other Wednesday. Don’t want to miss an update? Subscribe here to get the most recent data and analysis in your inbox.